At Phtaya, the safety and security of our users are at the heart of everything we do. As a trusted online betting platform, we’ve implemented a robust Phtaya KYC Policy—short for “Know Your Customer”—to safeguard our community and maintain a transparent environment. Whether you’re betting on PBA games, playing live casino tables, or withdrawing winnings, our KYC process ensures every transaction is secure and compliant. This guide dives deep into why we require identity verification, how it works, and how Phtaya protects your information in 2025.

What is KYC and Why Is It Important?

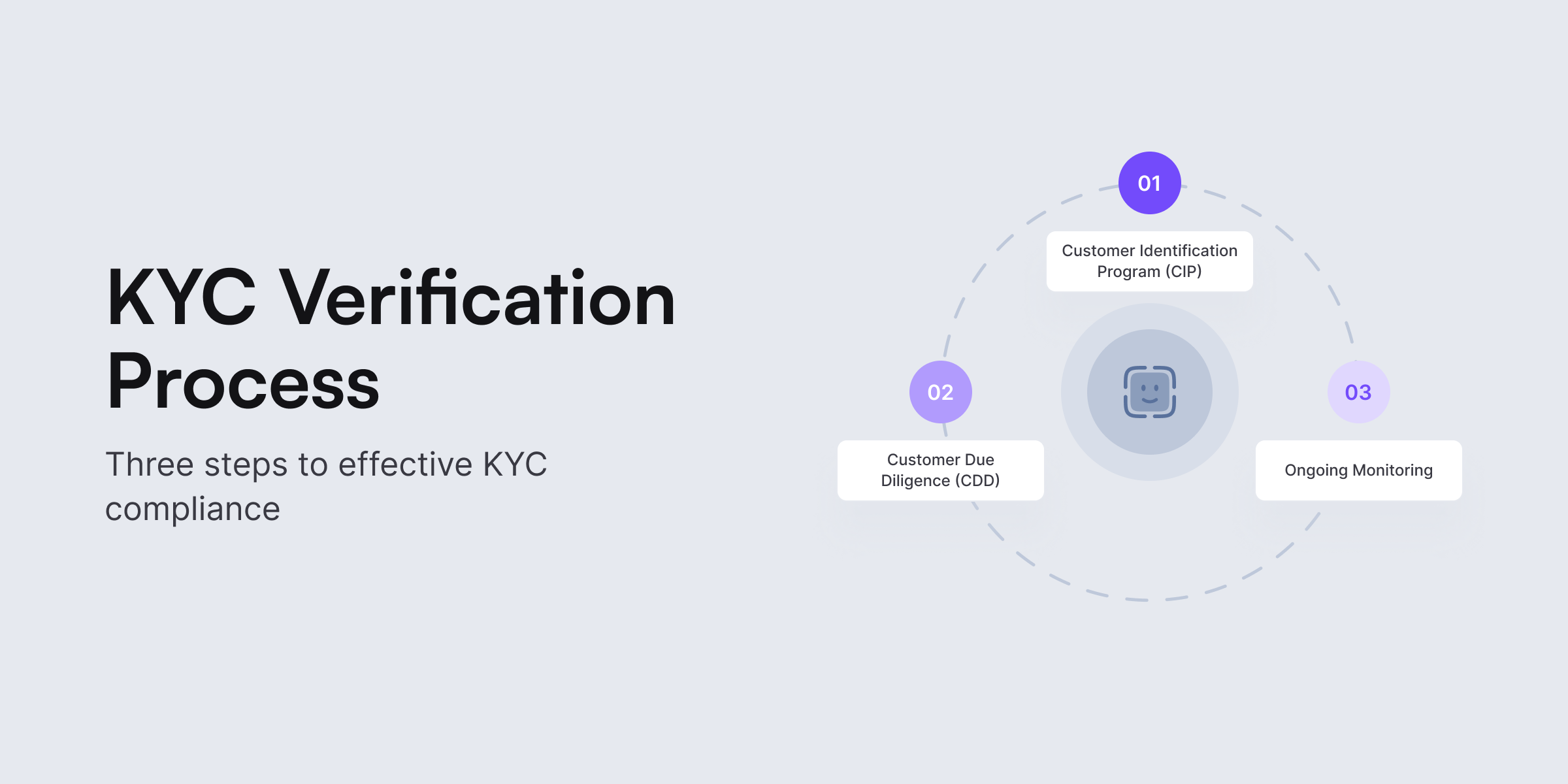

KYC, or “Know Your Customer,” is a standard procedure used by financial and gaming platforms worldwide to verify the identities of their users. At Phtaya, we see KYC as more than just a regulatory checkbox—it’s a cornerstone of our commitment to a safe and fair betting experience. By confirming who you are, we prevent fraud, protect your account, and uphold the integrity of our platform.

The Phtaya KYC Policy serves several critical purposes:

- Account Safety: It ensures your account and funds are protected from unauthorized access.

- Regulatory Compliance: We adhere to international and local laws, including anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

- Fraud Prevention: KYC stops identity theft, financial scams, and other illicit activities in their tracks.

- Responsible Gaming: Verification helps us promote healthy betting habits by ensuring users are of legal age and in control.

For Filipino bettors and players worldwide, this process is a reassurance that Phtaya prioritizes trust and reliability.

Information We Collect During KYC

To make the Phtaya KYC Policy effective, we collect specific details to verify your identity. Here’s what we may ask for:

- Personal Identification Information:

- Full name, date of birth, residential address, and contact details (phone number or email).

- A government-issued ID, such as a passport, driver’s license, or Philippine national ID (e.g., UMID or SSS ID).

- Proof of Address:

- Recent utility bills (electricity, water), bank statements, or government-issued residency documents showing your current address.

- Financial Information:

- Details of your payment methods, like bank account numbers, e-wallet IDs (e.g., GCash, PayMaya), or cryptocurrency wallet addresses.

- Additional Documentation:

- In rare cases, we might request further proof, such as a selfie with your ID or a document verifying your income source, to meet stricter compliance needs.

We keep this process as streamlined as possible, only requesting what’s necessary to ensure your account’s security.

How to Complete the KYC Process

Completing the Phtaya KYC Policy requirements is straightforward and user-friendly. Follow these steps to get verified:

- Log in to Your Phtaya Account

Access your account through the official Phtaya website or mobile app using your username and password. - Navigate to the Verification Section

Go to your account settings or dashboard and locate the “KYC Verification” or “Identity Verification” tab. - Submit Required Documents

Upload clear, high-quality scans or photos of your ID and proof of address. Ensure all details are legible—blurry images may delay approval. - Wait for Approval

Our verification team reviews your submission within 24–48 hours. You’ll receive a notification via email or the app once approved.

If there’s an issue (e.g., an unreadable document), we’ll let you know what to resubmit. It’s that simple!

How We Protect Your Information

Your privacy is non-negotiable at Phtaya. Under our Phtaya KYC Policy, we take extensive measures to safeguard your data:

- Encryption Technology: All uploaded documents and personal details are protected with advanced SSL encryption, preventing unauthorized access.

- Restricted Access: Only a small, trained team of authorized personnel can view your information, and they’re bound by strict confidentiality rules.

- Secure Storage: Your data is stored on encrypted servers that comply with global privacy standards, like GDPR and local Philippine regulations (e.g., Data Privacy Act of 2012).

- Data Minimization: We only collect what’s needed and delete unnecessary information once verification is complete, unless required by law to retain it.

With these protections, you can trust Phtaya to handle your details responsibly.

Why KYC is Essential for Phtaya Users

Completing the Phtaya KYC Policy isn’t just about compliance—it unlocks tangible benefits for you:

- Fast Transactions: Verified accounts enjoy quicker processing for deposits and withdrawals, often within hours via GCash or bank transfers.

- Increased Security: KYC adds an extra layer of protection, reducing the risk of account hacks or fraud.

- Better Account Management: A fully verified profile means fewer interruptions when accessing features like bonuses or high-stake bets.

- Peace of Mind: Knowing your account is secure lets you focus on enjoying the games, from slots to live betting.

For Filipino users, this means smoother cashouts to local e-wallets or banks, tailored to your everyday needs.

Frequently Asked Questions about Phtaya KYC Policy

Here are answers to common questions about the Phtaya KYC Policy:

- Q1: Is KYC mandatory for all Phtaya users?

Yes, all users must complete KYC to ensure compliance and maintain account security—especially for withdrawals.

- Q2: How long does the KYC verification process take?

Typically, it takes 24–48 hours, though accurate, clear submissions can speed this up. - Q3: Can I use my account without completing KYC?

You can access limited features (e.g., browsing or small deposits), but withdrawals and full functionality require verification. - Q4: What if my documents are rejected?

We’ll notify you with the reason (e.g., expired ID). Resubmit corrected documents, or contact support for help.

These FAQs address the essentials, ensuring you’re prepared for the process.

Changes to the KYC Policy

The Phtaya KYC Policy may evolve to meet new legal standards or enhance user safety. Updates could include additional verification steps or revised document requirements. We’ll notify you via email, app alerts, or our website’s news section. By continuing to use Phtaya, you agree to the latest policy terms—keeping us aligned with global best practices.

Tips for a Smooth KYC Experience

To breeze through the Phtaya KYC Policy:

- Use recent documents (e.g., utility bills within 3 months).

- Submit high-resolution images—avoid shadows or glare.

- Verify your email first to receive updates promptly.

- Reach out to support if you’re unsure about any step.

These pointers minimize delays and get you verified faster.

Contact Us

Need help with the Phtaya KYC Policy? Our customer support team is available 24/7 via live chat, email, or phone. Whether you’re stuck uploading a document or have a question about privacy, we’re here to assist. Reach out through our official channels for quick, friendly guidance.

Conclusion

The Phtaya KYC Policy is our promise to deliver a secure, transparent, and enjoyable betting experience. By verifying your identity, we protect your account, comply with regulations, and ensure fast, safe transactions—whether you’re cashing out to GCash or betting on your favorite sport. Complete your KYC today and unlock the full potential of Phtaya, where safety meets excitement in 2025!

CEO Miguel Santoro

Since its inception, Phtaya.us has provided red and black sports enthusiasts with an unparalleled betting experience. Under the leadership of CEO Miguel Santoro, the company has taken the right direction and set clear goals, propelling it to its current success. Join us in building the strongest bookmaker by website: https://phtaya.us/

CEO: Miguel Santoro

⭐️Year of Birth: 15/07/1986

⭐️Work Address: 123 Bonifacio St, Makati, Metro Manila, Philippines

⭐️Phone Number: (+63)7689234567

⭐️Email: [email protected]

⭐️Facebook: https://www.facebook.com/phtayaus

⭐️Twitter: https://twitter.com/phtayausCEO